AI Enablement

AI Integration vs Manual Processes: Which Delivers ROI?

Jan 23, 2026

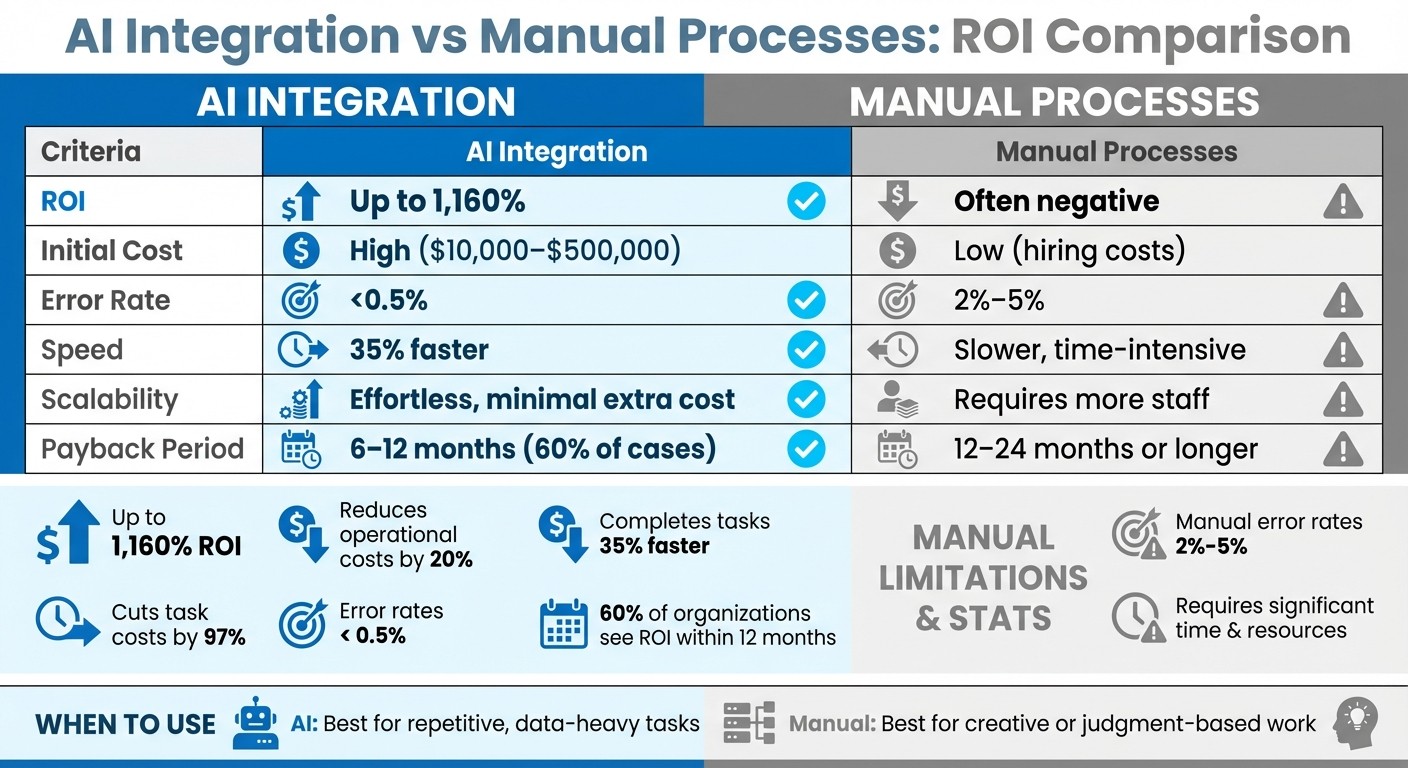

If you're deciding between AI integration and manual processes, here's what you need to know: AI consistently outperforms manual methods in ROI, speed, accuracy, and scalability. While manual processes have lower upfront costs, they become expensive over time due to errors and labor needs. AI, despite higher initial investments, delivers faster task completion, fewer errors, and long-term savings.

Key Takeaways:

ROI: AI delivers up to 1,160% ROI, while manual processes often struggle to break even.

Cost Efficiency: AI reduces operational costs by as much as 20% and can cut task costs by 97%.

Speed & Accuracy: AI completes tasks 35% faster with error rates below 0.5%, compared to manual rates of 2%-5%.

Scalability: AI handles growing workloads without extra staffing, unlike manual methods.

Quick Comparison:

Criteria | AI Integration | Manual Processes |

|---|---|---|

ROI | Up to 1,160% | Often negative |

Initial Cost | High (e.g., $10,000–$500,000) | Low (mainly hiring costs) |

Error Rate | <0.5% | 2%-5% |

Speed | 35% faster | Slower, time-intensive |

Scalability | Effortless, minimal extra cost | Requires more staff |

Payback Period | 6–12 months (60% of cases) | 12–24 months or longer |

AI works best for repetitive, data-heavy tasks, while manual methods suit creative or judgment-based work. Companies like JPMorgan Chase and Mastercard have saved millions annually through AI, proving its financial and operational advantages. To maximize ROI, businesses must carefully plan, measure, and allocate resources toward AI-driven transformation.

AI Integration vs Manual Processes ROI Comparison

Cost Analysis: Initial and Ongoing Expenses

Initial Investment Requirements

When considering AI integration, the upfront costs can be substantial. For example, entry-level chatbots typically start at around US$10,000, while enterprise-level systems with full CRM or ERP integration can exceed US$500,000. These costs encompass hardware like GPUs, software licenses for platforms such as Azure or Blue Prism, and data preparation, which alone can cost up to US$33,000. Additionally, integrating older legacy systems may require an extra US$10,000 to US$40,000.

On the other hand, manual processes involve much lower initial expenses. These are primarily tied to hiring and onboarding costs, which are spread out as part of monthly wages. While this lower upfront investment may seem appealing, the long-term financial dynamics often paint a different picture.

Operating Costs and Growth Capacity

Once an AI system is operational, its cost structure shifts from labour-heavy expenses to fixed technology costs like maintenance, cloud infrastructure, and API usage. Maintenance costs for AI systems generally range between US$5,000 and US$20,000 annually. Automated workflows, however, have the advantage of scaling with minimal additional expense. Over time, AI reduces long-term technical debt through efficiency and adaptability. This fixed-cost approach contributes to achieving a faster ROI.

In contrast, manual processes face escalating costs as workloads grow. For instance, doubling the workload often requires doubling the workforce. Furthermore, manual tasks are prone to error rates between 2% and 5%, while AI systems typically maintain error rates below 0.5%. Financial institutions that have adopted end-to-end automation report reductions in processing costs of up to 70%.

These operational differences highlight the financial benefits of AI over time.

Cost Trends Over Time

The long-term financial outlook for AI systems underscores their value. For example, revenue recognition tasks that cost US$1,600 per unit when done manually can drop to under US$50 with AI - a 97% reduction. JPMorgan Chase used robotic process automation (RPA) to handle 1.7 million IT access requests, a workload equivalent to 140 employees, and later saved 360,000 hours annually in its legal department through AI-driven loan agreement reviews. Similarly, Mastercard improved its financial reconciliation process, cutting it from 5 days to just 1 day, boosting accuracy from 91% to 99.8%, and saving approximately US$25 million annually.

Payback periods are another key consideration. About 60% of organizations see ROI within 12 months of implementing workflow automation. However, more complex AI applications may take 2 to 4 years to yield satisfactory returns. Companies that allocate over 20% of their IT budget to automation have achieved 22% cost savings, while those spending less than 5% report only 8% savings. Manual processes, in contrast, often struggle to deliver positive ROI as volumes grow. AI-native systems, meanwhile, can provide returns averaging 3.7 times the initial investment.

These trends strongly reinforce AI's ability to deliver better long-term cost efficiency compared to traditional manual processes.

Performance Comparison: Speed, Accuracy, and Capacity

Speed and Error Rates

AI systems are remarkably fast, processing data in seconds, while traditional manual workflows can take hours, if not days, to complete similar tasks. A striking example comes from October 2025, when Leapfin Co-Founder Erik Yao demonstrated an AI agent creating a complex revenue recognition rule - complete with multi-currency FX and custom tax logic - in just 25 minutes. In comparison, a senior accountant needed 16 hours to perform the same task manually using a spreadsheet. This represents an astounding 97% reduction in time. Another example from March 2024 shows Ring Container implementing Infor AI and Enterprise Automation to speed up customer inquiry processing by 96%, saving 12,000 work hours annually and cutting costs by US$102,000 each year.

When it comes to accuracy, AI systems consistently outperform humans. AI solutions maintain error rates as low as 0.5%, compared to the human error benchmark of 11.3%. Even when compared to AI-assisted workflows, human error rates stand at 6.8%. These differences have significant financial implications - a single production defect costs an average of US$4,467 to fix, while defects affecting customers can escalate to US$67,890. With such efficiency, AI not only boosts speed and accuracy but also effectively reduces costly errors, making it a powerful tool for managing complex tasks.

Handling Volume and Change

AI systems shine when workloads increase, scaling effortlessly without the need for additional staff. For instance, in June 2024, UPS reported that its Message Response Automation (MeRA), powered by large language models, handled part of its 50,000 daily customer emails, cutting email processing time by 50% and significantly boosting operational ROI. Similarly, in May 2023, Capital One's "Auto Navigator" machine learning platform prequalified users and underwrote auto loans in mere seconds. This not only increased loan originations but also enhanced customer satisfaction, showcasing how AI scalability directly drives revenue growth.

AI also adapts to changing business conditions seamlessly. With self-correcting capabilities, AI reduces maintenance overhead by over 95%. In contrast, manual processes require retraining staff and updating workflows - a time-intensive and costly bottleneck. AI automation in procurement, for instance, can improve functional efficiency by 30% to 50%, while its use in customer interactions has been shown to cut costs by up to 90%. This ability to handle growing demands and adapt to changes ensures AI delivers consistent performance and measurable results.

Time Required to Achieve ROI

One of AI's standout advantages is its ability to deliver returns much faster than manual methods. On average, AI integration reaches break-even 40% to 60% quicker. Around 60% of organisations using workflow automation report achieving ROI within 12 months, with some AI-powered systems delivering returns in just 3 to 6 months. For example, a Forrester study from July 2025 on the Five9 Intelligent CX Platform revealed that automating key activities saved 120 seconds per contact reaching an agent, generating US$3.5 million in value over three years. Similarly, modern accounts payable automation can achieve a 111% ROI with a payback period of less than 6 months. Meanwhile, manual processes, hindered by higher error rates and slower execution, often take 12 to 24 months - or longer - to deliver positive returns. These metrics highlight how AI accelerates ROI, making it an invaluable asset for businesses looking to optimise both financial and operational outcomes.

How to Calculate ROI: Methods and Metrics

Standard ROI Formula and Application

Once performance comparisons are complete, calculating ROI accurately is essential to confirm the benefits of integrating AI.

The ROI formula is straightforward: (Benefits – Costs) / Costs. To get a clear picture, include all components of the total cost of ownership (TCO). This means factoring in both one-time expenses - like project scoping, data labeling, integration, and change management (which can account for 20% to 40% of total budgets) - and ongoing costs, such as licensing fees, cloud services, GPU usage, model monitoring, and retraining.

Start by establishing a baseline over 8 to 12 weeks, focusing on key metrics like labor hours, error rates, cycle times, and production volume. Then, translate operational improvements into financial terms using simple formulas like:

Labor Savings: (Hours saved × Hourly labor cost)

Revenue Growth: (Conversion lift × Traffic × Average order value)

Risk Mitigation: (Reduction in incidents × Average cost per incident).

For mid-sized AI projects, the typical payback period ranges from 6 to 18 months. When projecting over multiple years, apply a discount rate - usually between 7% and 10% - to account for the time value of money and risks associated with implementation. To strengthen your ROI analysis, consider creating conservative, baseline, and optimistic scenarios to reflect potential adoption challenges and fluctuations in model performance.

Rebel Force's 4-Phase Measurement Process

Rebel Force has developed a systematic approach to simplify ROI tracking and ensure accurate evaluations. Their process is broken into four phases:

Diagnose: Review baseline KPIs over an 8–12-week period to understand the cost of inaction.

Design: Select 3–5 KPIs that directly align with business objectives and model potential outcomes.

Execute: Collect real-time data weekly to identify quick wins and measure progress.

Validate: Convert improvements into financial metrics like Net Present Value (NPV), Internal Rate of Return (IRR), and Payback Period.

This structured method tackles a major challenge: nearly 95% of AI investments fail to deliver measurable returns, often due to weak or non-existent measurement frameworks.

Metrics for Measuring Results

Once a solid measurement process is in place, the next step is to focus on quantifying efficiency, quality, growth, and risk.

Here are the key metrics to track:

Efficiency: Cycle time, throughput, and hours saved (multiplied by the hourly labor rate).

Quality: Error rates and rework frequency (multiplied by the cost per rework incident).

Growth: Conversion rates and lead volume (multiplied by traffic and average order value).

Risk: Incident rates and compliance fines (multiplied by the average cost per incident).

It’s important to differentiate between "hard ROI" - like labor cost reductions, lower operational expenses, and increased revenue per employee - and "soft ROI", which includes benefits like improved morale, better job satisfaction, and faster decision-making.

In September 2025, Chobani revolutionised its financial operations by leveraging AI. The company cut the time spent on expense processing by 75%, allowing its finance team to shift focus from tedious administrative work to strategic financial analysis and compliance.

To maximise ROI, ensure that any time saved is redirected to higher-value tasks. For example, aim to use reclaimed hours to generate 25 additional proposals per month. Lastly, allocate a 10% to 20% budget buffer for ongoing model updates and retraining. This helps prevent ROI from declining due to model performance degradation over time.

AI Integration with Rebel Force

Rebel Force's Service Options

Rebel Force provides two distinct service models to meet diverse business needs: a fixed-price 12-week Enablement Sprint and a 12-month Enablement Program. Both options follow a four-phase methodology - Diagnose, Design, Execute, and Validate - to implement AI solutions effectively.

The 12-week Sprint is ideal for companies looking for quick, impactful results. On the other hand, the 12-month Program is better suited for businesses dealing with complex legacy systems or those needing to integrate AI across multiple departments. The extended timeline ensures a smoother transition, thorough knowledge transfer, and minimal disruption to daily operations.

These customisable service models aim to deliver noticeable operational and financial benefits.

Measured Business Results

Rebel Force’s AI-driven solutions consistently lead to impressive outcomes: 20% to 35% revenue growth, 70% to 90% productivity improvements, and 70% higher customer satisfaction rates. Industry data further highlights the potential of AI integrations, showing returns on investment (ROIs) ranging from 214% to 761% over five years.

A significant portion of these productivity gains comes from rethinking and redesigning processes. Companies adopting this approach are shifting their IT budgets dramatically. Automation leaders, for instance, now allocate 67% of their IT spending to business transformation, compared to just 33% in 2023. This shift also reduces IT complexity and technical debt, cutting maintenance costs from 8% of revenue to 6.8%.

Rebel Force’s structured approach ensures clients achieve fast payback periods, typically between 6 and 12 months. Moreover, leading organizations are now dedicating 64% of their AI budgets to core business operations.

"AI's greatest potential lies not in making existing processes marginally more efficient, but in enabling entirely new approaches to value creation and delivery".

How to Identify High-ROI Use Cases for AI in Your Business

Conclusion: Selecting the Right Approach

When deciding between AI and manual methods, it’s essential to match the tool to the task. AI shines in handling repetitive, data-heavy operations where speed and precision can drive tangible results. On the other hand, manual methods are better suited for tasks that require creativity or strategic human judgment. Each has its place, and understanding when to use which is key.

The numbers tell a compelling story: companies that allocate 20% or more of their IT budgets to automation see an average cost reduction of 22%. Meanwhile, those investing less than 5% only achieve an 8% reduction. The real game-changer isn’t just the technology itself - it’s the commitment to rethinking entire processes rather than automating individual tasks. This underscores the importance of precise measurement and planning before diving into transformation efforts.

"AI isn't valuable on its own. It's valuable when it moves the needle on something the business already cares about." – SAP

Start by establishing a clear baseline. Document current performance metrics like processing times, error rates, and costs. Then, model potential ROI through scenarios such as cost reduction or revenue growth. Ignoring this step could lead to missed opportunities, as delays in adopting AI might result in lost revenue and diminished competitiveness.

Rebel Force offers a practical framework to turn these insights into measurable outcomes. Their structured programs - whether a 12-week Enablement Sprint or a 12-month Enablement Program - are designed to deliver results quickly. With typical payback periods ranging from 6 to 12 months, businesses that commit to transformation can expect a clear and measurable return on investment.

FAQs

What should businesses consider when evaluating the ROI of AI integration?

To gauge the return on investment (ROI) of integrating AI into your business, it’s important to keep a few critical factors in mind:

Set clear goals: Make sure your AI efforts are tied to specific outcomes, whether that’s reducing expenses, boosting decision-making accuracy, or driving revenue.

Focus on the right use cases: Pinpoint areas where AI can make a noticeable difference, such as streamlining operations, improving forecasting, or enhancing risk management.

Assess readiness: Confirm that your infrastructure, data quality, and team skills are up to the task of supporting AI initiatives.

Keeping an eye on metrics like cost reductions, process efficiencies, and customer satisfaction can help you measure AI’s impact on both finances and operations. A well-planned, strategic approach will help you get the most out of your investment and deliver real results.

How does using AI compare to manual processes in reducing long-term operational costs?

AI integration offers businesses a powerful way to cut long-term operational costs. By automating repetitive tasks and fine-tuning workflows, companies can see a noticeable drop in labor expenses, fewer mistakes, and smarter use of resources. For instance, businesses using AI-driven automation often report saving money through quicker problem-solving, higher efficiency, and less downtime.

On top of that, AI helps simplify operations by reducing the need for manual labor, addressing inefficiencies, and boosting productivity. Over time, these changes lead to clear cost reductions, proving that AI isn't just a tool - it's an investment that can drive sustainable growth.

When is it better to use manual processes instead of AI integration?

Manual processes shine in areas where human judgment, creativity, and personalized interactions are essential - qualities that AI simply can't replicate. Think about tasks involving sensitive decision-making, emotional intelligence, or complex negotiations. These require a level of adaptability and empathy that only humans can provide.

There are also situations where manual methods are the safer choice, such as dealing with confidential information. When security and control are paramount, trusting human oversight can help reduce risks. Similarly, tasks that are highly variable or too intricate for today's AI systems often benefit from human expertise. In these scenarios, relying on people ensures greater accuracy and helps to avoid costly mistakes.